⇒ Introduction:

Did you know that less than 30% of adults worldwide feel confident about their financial future? Financial freedom is the dream of millions. Achieving financial freedom before 40 might seem challenging, but it’s achievable with the right strategies.

In this article, we’ll guide you through 10 proven steps to help you break free from financial constraints (a limitation or restriction), build wealth, and live a life of independence. The 10 Proven Strategies

⇒ Following are the 10 Proven Strategies to Achieve Financial Freedom Before 40.

1) Develop a Clear Financial Plan

Why it matters: Without a roadmap, you’re driving blind when it comes to money.

Steps to create a financial plan:

- Identify your long-term financial goals (e.g., saving $1M by 40).

- Break these goals into short-term targets (e.g., saving $20K annually).

- Use tools like YNAB (You Need A Budget) or Mint for tracking progress.

Pro Tip: Review and adjust your plan annually to reflect changes in your life and income.

2) Increase Your Income Streams

Why it matters: Relying on a single income stream limits your potential for wealth.

Methods to boost income:

- Start a side hustle: Freelancing, blogging, or selling products online.

- Invest in dividend-yielding stocks (a company pays out to shareholders in relation to its stock price) or rental properties.

- Monetize a skill, such as tutoring, graphic design, or consulting.

Real-Life Example: Sarah, a teacher, launched an online course on educational techniques and now earns an extra $2,000/month.

3) Practice Frugality and Smart Spending

Why it matters: Every dollar saved is a dollar earned.

Tips for frugal living:

- Adopt the 50/30/20 rule: 50% for needs, 30% for wants, 20% for savings.

- Shop during sales, and use cashback apps like Rakuten.

- Cut non-essential subscriptions (e.g., unused gym memberships).

Budgeting Tool: Use PocketGuard to control impulse spending.

4) Invest Wisely

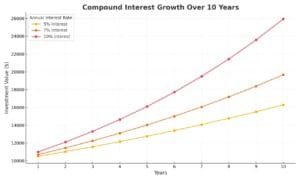

Why it matters: Compound interest is the secret to building wealth over time.

Investment options:

- Stocks: Opt for ETFs or index funds for diversification (Investing strategy used to manage risk).

- Real estate: Invest in rental properties or REITs (Real Estate Investment Trusts).

- Retirement accounts: Max out your 401(k) or IRA (Individual Retirement Account) contributions.

Infographic Suggestion: A graph showing how $10,000 grows over 10 years with compound interest at 7%.

5) Eliminate Debt Efficiently

Why it matters: High-interest debt is a major obstacle to financial independence.

Strategies to pay off debt:

- Use the debt snowball method: Pay off smaller debts first to gain momentum.

- Negotiate lower interest rates with lenders (a group (public or private), or a financial institution that makes funds available to a person or business with the expectation that the funds will be repaid).

- Consolidate debts using balance transfer credit cards.

Pro Tip: Focus on paying off debts with interest rates above 7% first.

6) Build an Emergency Fund

Why it matters: Life is unpredictable, and an emergency fund safeguards against setbacks.

- How much to save: Aim for 3–6 months’ worth of living expenses.

- Where to save: Open a high-yield savings account like Ally Bank or Marcus by Goldman Sachs.

Reader Poll: How many months of expenses do you currently have saved? *Comment your answer while mentioning this poll.

7) Continuously Educate Yourself

Why it matters: Financial literacy empowers you to make smarter decisions.

Resources to learn from:

- Books: The Millionaire Next Door by Thomas J. Stanley.

- Podcasts: The Dave Ramsey Show or BiggerPockets Money.

- Courses: Platforms like Coursera and Skillshare.

8) Network with Like-Minded Individuals

Why it matters: Surrounding yourself with financially savvy peers accelerates growth.

How to find communities:

- Join personal finance forums like Reddit’s r/personalfinance.

- Attend meetups or webinars focused on investing or wealth-building.

- Participate in LinkedIn groups related to financial planning.

9) Maintain Discipline and Patience

Why it matters: Wealth-building is a marathon, not a sprint.

Techniques for staying committed:

- Automate savings and investments to avoid temptation.

- Celebrate small wins to maintain motivation.

- Track progress monthly to stay focused on your goals.

10) Seek Professional Advice When Needed

Why it matters: Financial advisors can help optimize your strategy and avoid costly mistakes and saves your time a lot.

When to consult a professional:

- Complex tax situations or estate planning.

- Major life events like marriage, children, or career changes.

- Choosing between investment options.

Suggestion: Use tools like SmartAsset to find a trusted financial advisor.

⇒ Conclusion

Achieving financial freedom before 40 requires focus, strategy, and commitment. Start small but think big—every step you take today moves you closer to independence tomorrow. Are you ready to take charge of your financial future? Share your journey or questions in the comments below!

⇒ FAQs

- What is financial freedom?

Financial freedom means having enough wealth to cover living expenses without relying on active income.

- How can I start saving if I’m in debt?

Begin with the snowball method to pay off small debts and reallocate those funds toward savings. Describes in step 5

- Are side hustles essential for financial freedom?

While not mandatory, they significantly accelerate wealth-building.

- What is the best investment option for beginners?

Index funds and ETFs are beginner-friendly and offer low-risk diversification. Note: Make your proper research before starting anything.

- How long does it take to achieve financial freedom?

It varies, but with consistent effort, most can achieve it within 10–15 years.

Note:

Have Questions?

Feel free to leave a comment on the post! Our team is here to respond to your queries as quickly as possible, or visit Contact Us page.

Thank You for Visiting Questinate!

We’re thrilled to have you explore our site for tips, knowledge, and insights. Stay updated with fresh, valuable blogs by visiting us daily.

Spread the Word!

If you found this helpful, share it with your friends and family: Questinate.com

We look forward to seeing you again soon!